It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. Only two more steps remain in our quick exercise, starting with the calculation of the contribution margin per unit – the difference between the selling price per unit and variable cost per unit – which equals $30.00. The contribution margin ratio is used by finance professionals to analyze a company’s profitability. It is often used for building a break-even analysis, which helps companies determine at what point a new business project will reach enough sales to cover the costs.

How do you calculate the weighted average contribution margin?

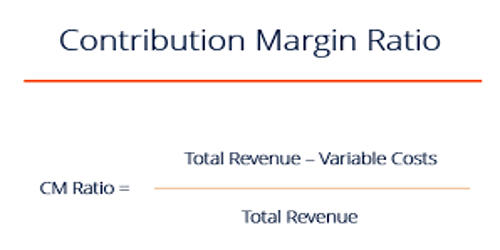

The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. For example, it can help a company determine whether savings in variable costs, such as reducing labor costs by using a new machine, justify xero vs zoho books the increase in fixed costs. This assessment ensures investments contribute positively to the company’s financial health. Let’s examine how all three approaches convey the same financial performance, although represented somewhat differently.

Business Cards

Doing this break-even analysis helps FP&A (financial planning & analysis) teams determine the appropriate sale price for a product, the profitability of a product, and the budget allocation for each project. The contribution margin is not necessarily a good indication of economic benefit. Companies may have significant fixed costs that need to be factored in.

- The greater the contribution margin (CM) of each product, the more profitable the company is going to be, with more cash available to meet other expenses — all else being equal.

- In short, it is the proportion of revenue left over after paying for variable costs.

- Fixed costs are costs that are incurred independent of how much is sold or produced.

Calculate Total Variable Cost

Say a machine for manufacturing ink pens comes at a cost of $10,000. Striking a balance is essential for keeping investors and customers happy for the long-term success of a business. A firm’s ability to make profits is also revealed by the P/V ratio. With a high contribution margin ratio, a firm makes greater profits when sales increase and more losses when sales decrease compared to a firm with a low ratio.

Step 2 of 3

Buying items such as machinery is a typical example of a fixed cost, specifically a one-time fixed cost. Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. Suppose Company A has the following income statement with revenue of 100,000, variable costs of 35,000, and fixed costs of 20,000.

How to calculate contribution margin

The benefit of expressing the contribution margin as a percentage is that it allows you to more easily compare which products are the most valuable to your business. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred.

The best contribution margin is 100%, so the closer the contribution margin is to 100%, the better. The higher the number, the better a company is at covering its overhead costs with money on hand. Another common example of a fixed cost is the rent paid for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold. 11 Financial is a registered investment adviser located in Lufkin, Texas.

If you need to estimate how much of your business’s revenues will be available to cover the fixed expenses after dealing with the variable costs, this calculator is the perfect tool for you. You can use it to learn how to calculate contribution margin, provided you know the selling price per unit, the variable cost per unit, and the number of units you produce. The calculator will not only calculate the margin itself but will also return the contribution margin ratio.

Leave a Reply